Plans & Pricing

Flexible Pricing Options to Suit Your Needs

Tailored Pricing for Your Business Needs

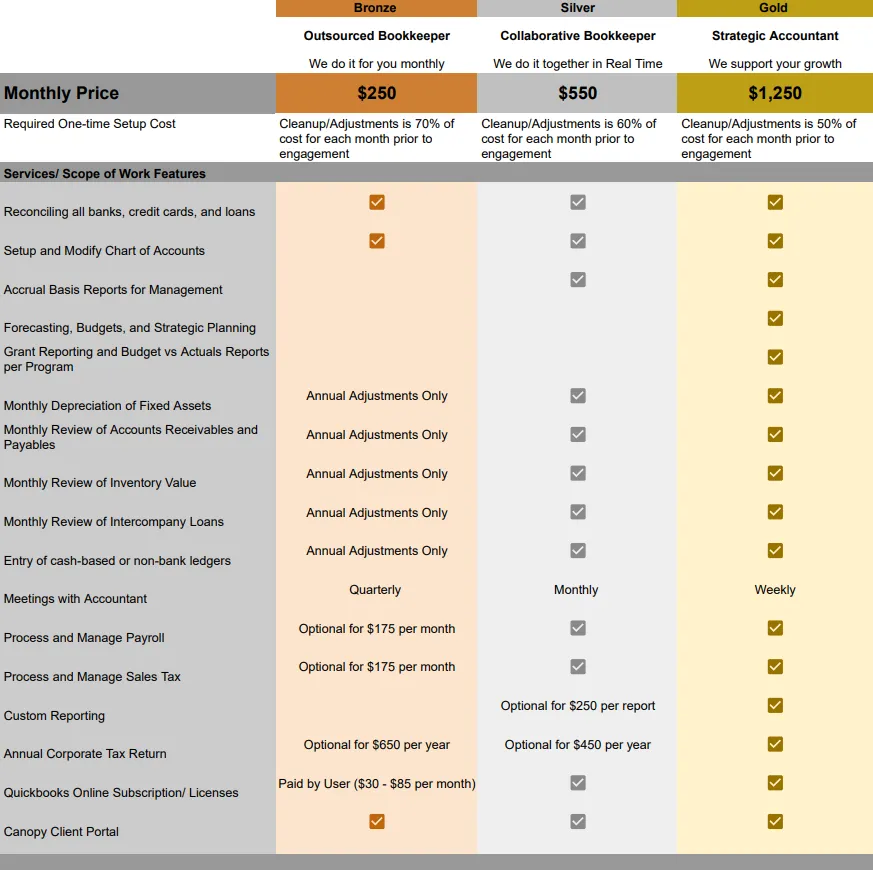

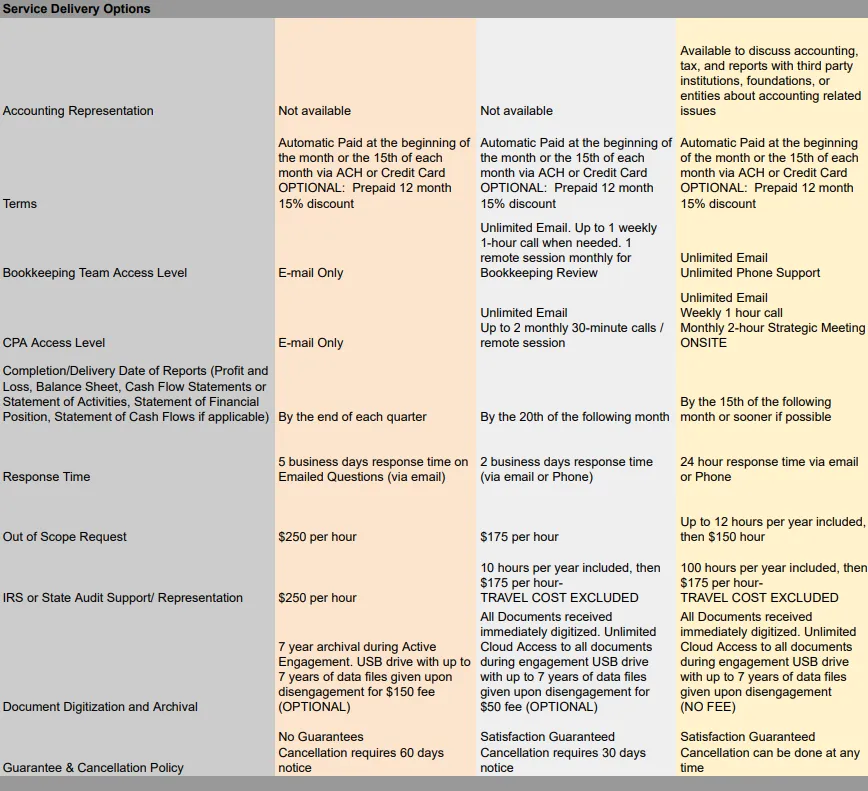

Bronze

Outsourced Bookkeeper

We do it for you monthly.

$250

/MONTHLY

Required One-time Setup Cost

Cleanup/Adjustments is 70% of cost for each month prior to engagement

Full set of financial statements

Reconciling all banks, credit cards, and loans

Setup and Modify Chart of Accounts

Quarterly consultations

Full Online Booking, Pipelines, Social Calendar, Website Builder, And More!

Silver

Collaborative Bookkeeper

We do it together in Real Time

$550

/MONTHLY

Required One-time Setup Cost

Cleanup/Adjustments is 60% of cost for each month prior to engagement

Everything In Bronze

Monthly depreciation of fixed assets

Monthly consultations

QuickBooks Online subscription

Process and manage payroll

Gold

Strategic Accountant

We support your growth

$1,250

/MONTHLY

Required One-time Setup Cost

Cleanup/Adjustments is 50% of cost for each month prior to engagement

Everything In Silver

Weekly consultations

Forecasting, Budgets, and Strategic Planning

Grant Reporting and Budget vs Actuals Reports per Program

Custom Reporting

Annual Corporate Tax Return

Find the Perfect Plan for Your Business

Explore transparent pricing options, feature breakdowns, and select the best value for your investment.

Frequently Asked Questions

Why is bookkeeping important for a business?

Accurate bookkeeping is crucial for businesses to understand their financial health, make informed decisions, comply with tax regulations, and demonstrate transparency to stakeholders like investors and creditors.

What is the difference between bookkeeping and accounting?

Bookkeeping involves the recording of financial transactions, while accounting includes interpreting, classifying, analyzing, and summarizing financial data. Bookkeeping is a subset of accounting, and both are essential for maintaining financial health.

What information do I need to provide to a bookkeeping service?

You'll typically need to provide bank statements, invoices, receipts, and any other relevant financial documents. Additionally, information about your business structure, tax IDs, and industry specifics may be required.

How do bookkeeping services help with tax preparation?

Bookkeeping services ensure that all financial transactions are accurately recorded and categorized. This organized data simplifies the tax preparation process, making it easier for accountants to file taxes and claim deductions.

Can I do my own bookkeeping?

Yes, many small businesses handle their own bookkeeping, especially with the help of accounting software. However, hiring a professional bookkeeping service can ensure accuracy, save time, and provide expertise in managing financial records.

Is my financial data secure with a bookkeeping service?

Reputable bookkeeping services prioritize data security. We use secure, encrypted platforms for data storage and transmission. It's advisable to inquire about the security measures and compliance with data protection regulations for any firm you work with.

Copyright© Pettes LLC. All Rights Reserved. The content, design, and arrangement of elements in this site.

pettes@teampettes.com

(855) 773-8837